German AOK Health Card Application for International Students

In Germany, having health insurance is obligatory, including for foreign residents and international students. Below you will learn a bit about the bureaucratic part of this system.

Table of contents

- Who needs student health insurance in Germany?

- AOK health insurance benefits

- How to choose a health insurance provider

- How to apply for a German electronic Health Card?

- Documents required to apply for AOK

- German Health Card photo requirements

- AOK Health Card price

- When and how to switch from student to worker insurance

Who needs student health insurance in Germany?

Health insurance is mandatory for all students studying in Germany, but the type of insurance required may vary depending on your nationality and type of study program.

EU vs. non-EU students

EU/EEA students can often use their existing European Health Insurance Card (EHIC) to access medical services in Germany. However, they must confirm with their university whether it is accepted for enrollment.

Non-EU students are generally required to take out German health insurance — either public (statutory) or private, depending on eligibility.

Students in different study programs

- Bachelor’s and master’s degree programs: Eligible for public student health insurance (e.g., AOK, TK) if under age 30 and within the regular study period.

- Preparatory or foundation courses (Studienkolleg): Typically eligible for public health insurance.

- Language school students: Often not eligible for public insurance and must take out private health coverage until they begin a degree program.

Always carry your health insurance card and present it at every doctor’s appointment, pharmacy, or hospital visit. This ensures that the billing is handled directly between the medical provider and the insurer (such as AOK), meaning you won’t have to pay upfront for covered services.

AOK health insurance benefits

First and foremost, having health insurance allows you to meet a mandatory requirement — all students must have valid health insurance before enrolling in a university in Germany. More importantly, it protects you financially if you become ill or injured, ensuring that you won’t have to cover the high costs of medical care out of pocket.

The specific benefits of your insurance depend on the insurance policy. But in general, your insurance provider pays out (whether partly or fully) for medical (and dental) treatments, medicine, therapy, assistive equipment, and hospital treatment. Besides treatment, they also pay for its policyholders’ legally required preventive examinations.

Public vs. private insurance: what’s the difference?

Germany has two main types of health insurance systems: public (statutory) insurance and private insurance. Understanding the difference between them is essential when choosing the right plan for your studies.

Public insurance (also called statutory insurance or "gesetzliche Krankenversicherung") is the standard option for most students. Providers like AOK, TK, and Barmer offer comprehensive coverage at reduced student rates. Students under the age of 30 and in their first degree program are usually eligible for public insurance. It is widely accepted across Germany and typically includes coverage for doctor visits, hospital treatment, prescriptions, mental health care, and preventive services.

Private insurance may be an option for students who are:

- Over the age of 30

- Enrolled in language or preparatory courses (Studienkolleg)

- No longer eligible for public insurance due to prior coverage or degree status

While private insurance can sometimes be cheaper on a monthly basis and offer more flexible packages, it may not cover all treatments and can be harder to switch away from later. Additionally, not all doctors accept private insurance, and you may have to pay upfront and request reimbursement. For most students, especially international ones, public insurance is the safer and more straightforward choice.

How to choose a health insurance provider

When selecting a health insurance company in Germany, it's important to compare several factors to find the one that best fits your needs. Major public providers like AOK, TK, Barmer, and DAK all offer student-friendly plans, but they differ in a few key areas.

One of the first things to consider is the monthly premium. While rates are generally similar, some providers may have slightly higher or lower regional contributions. It's also worth checking whether the insurer offers good customer service in English, especially if you're an international student unfamiliar with the German healthcare system.

Beyond the basics, many providers offer extra services that can add real value — such as user-friendly mobile apps for managing appointments and claims, digital doctor consultations, and mental health support. These features can make managing your health easier and more accessible while studying in Germany.

How to apply for a German Electronic Health Card?

To receive an electronic health insurance card (elektronische Gesundheitskarte or eGK), you must first register as a member with a health insurance provider, such as AOK. The process for joining AOK typically involves the following steps:

- Fill out the membership application form online. You can complete it digitally or choose to print it out.

- If needed, download and print the form, then fill in any remaining details by hand.

- Sign the completed form and submit it to your nearest AOK branch office either in person or by post, so your application can be processed.

Once your membership is confirmed, AOK will issue your electronic health card and mail it to your registered address. You’ll need this card to access medical services, such as doctor visits, hospital care, and pharmacy prescriptions.

Documents required to apply for AOK

To apply for student health insurance in Germany, you will typically need to provide the following documents:

- Passport: A valid passport to verify your identity and nationality.

- University acceptance letter: Proof of admission or enrollment at a recognized German higher education institution.

- Completed application form: Either filled out online or printed and signed by hand.

- Passport-size photo (optional): Some providers may request a photo for issuing the health insurance card.

- Previous insurance certificate (if transferring): If you were previously insured in Germany or another EU country, you may need to show proof of prior coverage.

German Health Card photo requirements

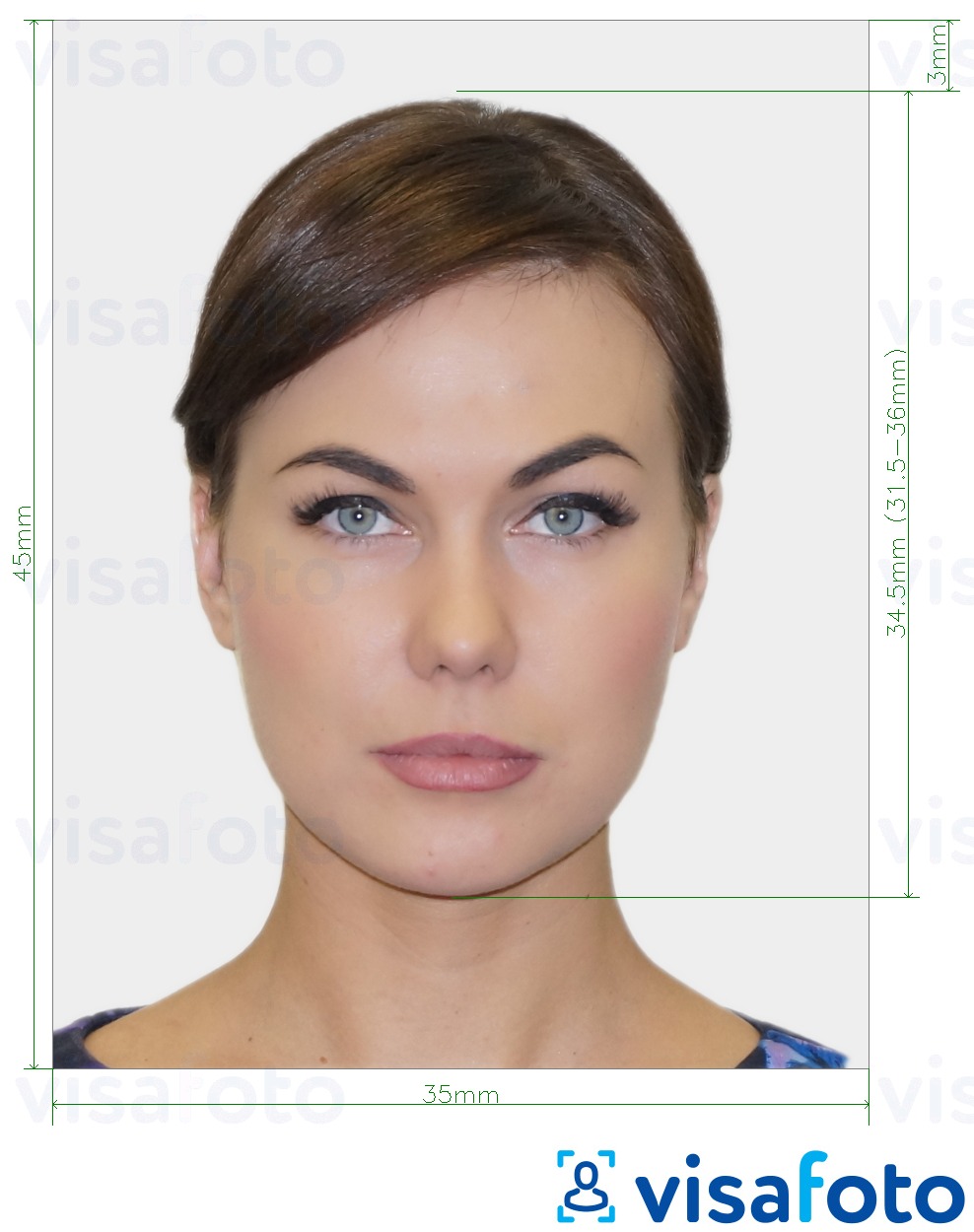

The insurance photo specifications are similar to passport photo requirements:

- The image size is 35 by 45 millimeters;

- The image must have adequate brightness and contrast and show natural skin tone;

- It should show a close-up of the head and (partial) shoulders;

- Your head must be looking straight forward, centered with neutral expression and in sharp focus, and clear with no ink marks/creases/lines;

- The face (from forehead edge to bottom of chin) should be 70 to 80% of the photo, the optimal face height is 32 to 36 mm;

- The eyes must be open and no hair obscuring the face;

- Prescription glasses are allowed but have to be clear and thin framed and should not have flash reflection or obscure the eyes;

- Head coverings, hair, head-dress or facial ornaments should not obscure the face;

- The photo must have a plain light background with no other people or objects in the photo;

- The lighting must be uniform with no shadows on the face or behind;

- Photos should not have red eyes.

Example of a photo for a German Health Card:

Source

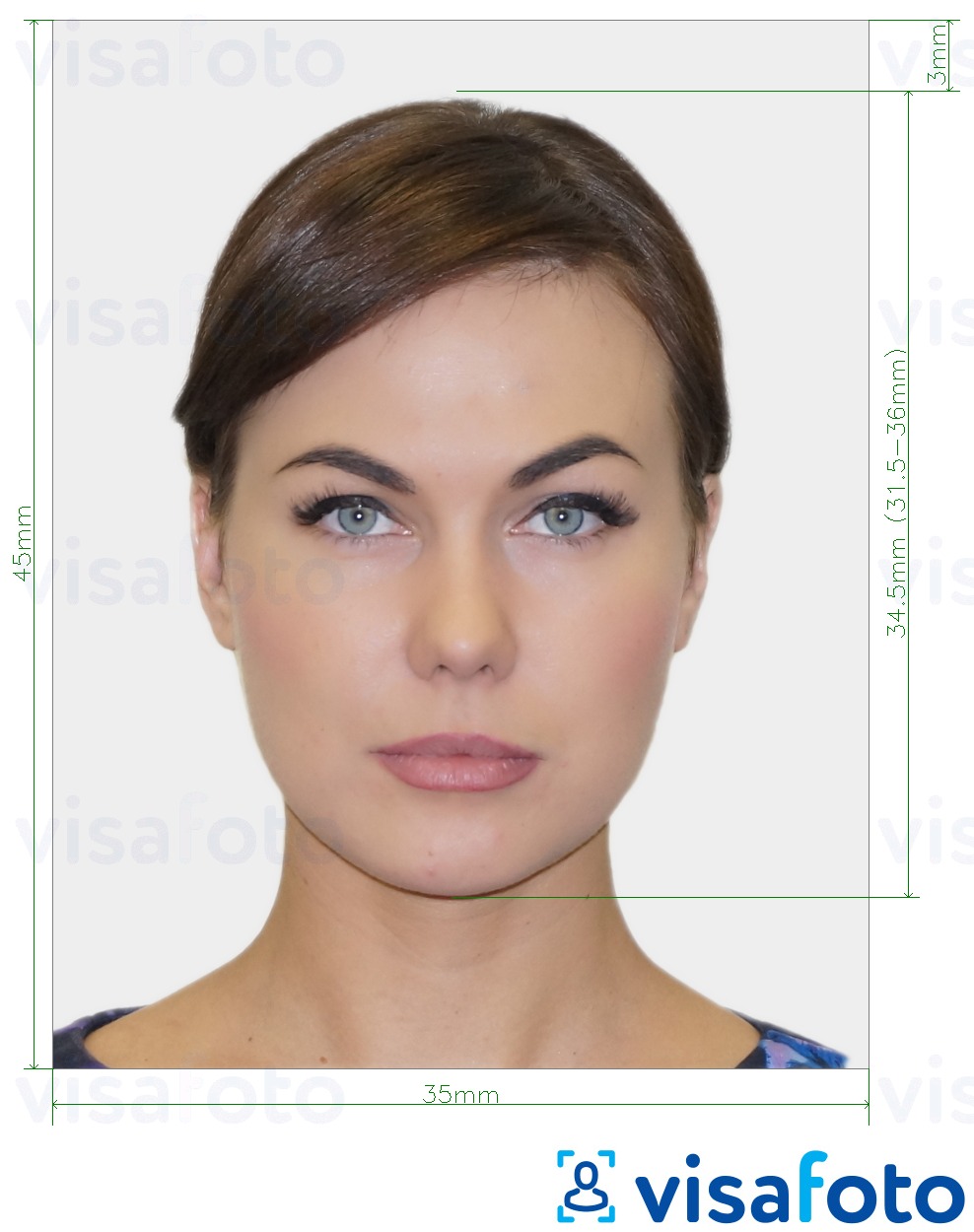

Result

First, take a photo of yours like this under daylight:

You will have two types of photos: a digital one for electronic applications and another one suitable for printing.

Here they are:

AOK Health Card prices

The health insurance card itself is free and is included with your policy — you don’t pay separately for it. However, the cost of the insurance varies based on your provider, location, and policy type.

For example, as of January 2025, the student health insurance premium (Krankenversicherung) through AOK is around €108–€111 per month, depending on the regional branch :contentReference[oaicite:1]{index=1}. On top of that, you’ll pay a mandatory long-term care insurance (Pflegeversicherung) contribution. For students under 23 or with children, this is approximately €30.78. For those aged 23 or older without children, the rate increases to about €35.91 per month :contentReference[oaicite:2]{index=2}.

Here’s a breakdown:

- Student health insurance (Krankenversicherung): ~€108–€111/month

- Long‑term care insurance (Pflegeversicherung):

- <23 years or with children: ~€30.78

- ≥23 years, no children: ~€35.91

Average total monthly cost for a typical student in 2025 is around €139–€146, combining both contributions :contentReference[oaicite:3]{index=3}.

Prices may be slightly higher or lower depending on your specific AOK branch and any additional “Zusatzbeitrag” (supplementary fee). This can push the combined costs of health and care insurance up to about €150/month :contentReference[oaicite:4]{index=4}.

Keep in mind these rates are updated annually. For the most accurate and personalized pricing, check with your chosen insurer or their local branch.

When and how to switch from student to worker insurance

After you graduate or start working part-time while studying, your student insurance may no longer be valid — especially if your monthly income exceeds the threshold of €538 in 2025. In such cases, you are required to switch from student insurance to regular public or private health insurance.

The transition typically happens when you either start full-time employment or earn enough through part-time work to be considered an employee under German law. Once this happens, your employer will usually register you with a health insurance provider of your choice and contributions will be automatically deducted from your salary.

If you're moving directly from your studies to a job, you should inform your current insurance provider about the change as soon as you receive a work contract. This ensures that your new policy starts seamlessly and avoids any gaps in coverage. Deadlines are strict — in most cases, you must register for the new insurance within two weeks of starting your employment.

It’s also important to know that once you switch out of student insurance, you cannot return to it, even if you resume studies later. That’s why it’s crucial to plan your transition carefully and make sure your new coverage meets your health and financial needs.

Frequently Asked Questions

Can I use travel insurance to enroll?

No, travel insurance is not accepted for university enrollment in Germany. You need a recognized public or private health insurance policy that meets the German healthcare requirements for students. Travel insurance is only suitable for short stays or while waiting for your official policy to begin.

Is my home country insurance accepted?

If you're from an EU/EEA country and have a valid European Health Insurance Card (EHIC), you may be able to use it to enroll. For non-EU students, foreign insurance is usually not accepted unless it meets strict German requirements — in most cases, you'll need to sign up with a German provider.

What if I arrive before my policy starts?

If you enter Germany before your health insurance becomes active, consider purchasing temporary travel insurance to cover the gap. Some providers offer short-term policies designed for this purpose. Be sure to avoid remaining uninsured, as even a small accident could result in high medical costs.

Can I cancel mid-semester?

Generally, student health insurance runs continuously and cannot be canceled mid-semester unless you officially leave the country, switch to a different type of insurance (like private or employment-based), or withdraw from your studies. Always contact your provider to discuss valid cancellation options.

Is dental treatment fully covered?

Basic dental care, such as check-ups and standard fillings, is usually covered by public health insurance. However, more complex procedures like crowns, braces, or implants may only be partially covered or not at all. If you expect dental work, consider supplemental dental insurance for broader coverage.

Last Update: July 2025