Complete guide to Germany freelance visa 2025–2026 for non-EU citizens

Non-EU citizens can work independently in Germany through a specific residence permit: the freelance visa. It allows professionals in fields such as IT, design, writing, consulting, and art to legally live and work on their own terms.

Applying for this visa is straightforward once you understand the process. Below, we explain everything you need to know about the "Freiberufler Visa" in Germany for 2025–2026.

Table of contents

- German freelance visa benefits and rules

- Difference between freelance visa and EU Blue Card, artist visa, and work visa

- Who is eligible for a freelance visa in Germany?

- Step-by-step application process

- Documents required for a German freelance visa application

- German visa photo requirements

- Get your German visa photo online instantly

- German visa photo app

- German freelance visa costs

- Freelance visa processing time

- Taxes, social security, and business registration rules

- Freelance visa extension and residence permit

- FAQ

German freelance visa benefits and rules

Germany visa for digital nomads allows self-employed professionals to live and work independently while contributing to the local economy. It offers the freedom to work with multiple clients, flexible income opportunities, and a path to long-term residence. Knowing these benefits and obligations helps applicants plan their careers effectively.

Key benefits are as follows:

- You can work for multiple clients in Germany and internationally, enjoying broad professional freedom.

- Visa holders can visit the Schengen Area for up to 90 days within a 180-day period.

- You can deduct business and home office expenses from your taxes.

- After six years, or possibly sooner with integration courses, you can apply for permanent residency and eventually German citizenship (note that dual citizenship is generally not allowed).

- The permit is initially valid for 1–3 years and can be renewed if you meet certain requirements and maintain economic activity.

Can I freelance in Germany without an EU passport? Yes, non-EU citizens can legally freelance in Germany through the Freiberufler programme if they fulfil the visa's criteria.

To apply, you need proof of qualifications, contracts with German clients, and a viable business plan. Show evidence of sustainable income to cover your expenses in Germany. The typical income requirements for a Germany freelance visa are as follows:

- Annual income: Aim for an income between €9,000 and €12,000 per person through projected earnings, signed client contracts, or savings as evidence of financial sustainability. To meet freelance visa requirements in Berlin, ensure your gross monthly income covers rent, health insurance, and at least €563, showing you can handle basic living expenses.

- Supporting dependents: If you have a spouse or children, you must demonstrate a higher income to sufficiently cover their expenses.

- Applicants over 45: You may need to provide evidence of retirement plans, such as a pension yielding at least €1,565.03 per month for 12 years post-age 67 or assets worth €225,364 if self-employed.

German self-employment visas are initially valid for 1 to 3 years and can be renewed with updated financial information, freelance contracts, and health insurance. Transitioning to other visa types, like work visas, is possible if you fulfil those specific criteria. After several years of legal and consistent freelance work, you can apply for permanent residence.

Freelancers must register with the local tax office and adhere to German income tax and VAT regulations if applicable. While you can work with many clients, being employed by a single employer is prohibited.

Difference between freelance visa and EU Blue Card, artist visa, and work visa

While all these visas allow foreigners to work in Germany, they serve different professional situations. Knowing the distinctions helps you choose the right option for your work setup and future goals. The key differences are summarised in the table below:

| Aspect | Freelance Visa | EU Blue Card | Artist Visa | Work Visa |

|---|---|---|---|---|

| Purpose | For self-employed freelancers in liberal professions and intellectual work | For highly skilled workers with job offer from German employer | Specialized freelance visa for artists and creatives | For employed individuals with a German job offer |

| Eligibility | Requires proven skills/qualifications and freelance contracts in approved freelance professions | Requires university degree or equivalent and job offer meeting salary threshold (~€45,300/year in 2025) | Similar to freelance visa but focused on arts and culture | Requires employer sponsorship and job contract |

| Employer requirement | None (work independently for multiple clients) | Yes, must have concrete job offer with employer | None (freelance work, usually individual contracts) | Yes, sponsored by a German employer |

| Initial validity | 1–3 years | Up to 4 years | 1–3 years | Usually matches duration of employment contract (6 months to 3 years) |

| Work restrictions | Can work for multiple clients, no fixed employer | Restricted to sponsoring employer initially | Can work on various freelance artistic projects | Restricted to sponsoring employer specified in visa |

| Path to permanent residency | After 3–5 years, with continuous activity and residence | Faster track: usually after 33 months, or 21 months with language proficiency | Same as freelance visa | After 5 years typically |

| Extension | Renewable if freelance activity continues with proof of income and contracts | Renewable if employment continues and salary threshold met | Renewable under same conditions | Renewable with continued employment |

| Examples of professions | IT consultants, translators, doctors, engineers, writers, architects | Engineers, IT specialists, doctors, academics | Visual artists, musicians, performers | Any skilled job with employer contract |

Who is eligible for a freelance visa in Germany?

Eligibility for the German freelance visa depends on your profession, financial stability, and demand for your services in Germany. Applicants must prove they can sustain themselves and that their work benefits the local economy. Below, we explain who qualifies and what criteria immigration authorities assess:

- Age. You must be at least 18 years old.

- Professional and economic impact. Eligibility requires working as a freelancer or being self-employed in liberal, artistic, or intellectual professions (e.g., doctor, lawyer, designer). You must demonstrate the value of your work to the local economy.

- Qualifications. Provide necessary professional qualifications or licences, especially if you’re in a regulated profession.

- Financial stability. Show bank statements or client contracts proving your ability to support yourself financially.

- Accommodation. Secure and provide evidence of accommodation in Germany.

- Health insurance. Ensure you have valid health insurance coverage in Germany.

- Client engagement. Obtain at least two contracts or letters of intent for a freelance visa from German clients demonstrating the economic or cultural benefits of your work.

- Pension provision for those over 45. Show evidence of sufficient retirement provisions through private savings, public pension rights, or significant business assets.

- Language and education. Speaking German or holding a university degree is not mandatory, unless required by your profession.

- Genuine activity. Conduct genuine freelance activities with diverse clients, avoiding dependency on a single client or any form of fake self-employment.

- Non-liberal professions. If self-employed outside liberal professions, prove a positive economic impact, such as serving German clients or employing locals.

Step-by-step application process

Applying for a German freelance visa involves several stages, from preparing your documents to attending an interview at the immigration office. Each step requires accuracy and good planning to avoid delays or rejections. Follow these steps to ensure a smooth process and avoid any setbacks:

- Gather all the necessary documents listed below in the article.

- Book an appointment at the nearest German Embassy or Consulate to submit your application.

- Attend your scheduled appointment to submit your documents, provide biometric data like fingerprints, and discuss your freelance business plan and intentions for working in Germany during a short interview.

- Wait for the processing of your application. If your current visa expires before a decision is made, you may receive a temporary permit.

- Once your visa is approved, you can travel to Germany.

- Upon arrival in Germany, register your address at the local Bürgeramt and with the Finanzamt to obtain a tax number (Steuernummer) for invoicing clients.

- Arrange a meeting at the local Ausländerbehörde (foreigners' office) to convert your visa to a residence permit if necessary, or renew it after its initial period.

You can begin your freelance work as soon as your visa or residence permit is activated.

Documents required for a German freelance visa application

Successful visa approval depends on submitting a complete and well-prepared application package. You’ll need to provide proof of professional qualifications, financial means, and business intent, among other documents. Below is the list of documents you should prepare:

- Valid passport, that is no older than 10 years, valid for at least another year, with two blank pages, accompanied by photocopies of the data page.

- Visa application form. Complete and sign two copies of the form.

- Biometric passport photos. Two recent photos that meet German standards.

- Letter of motivation. Describe your reasons for freelancing in Germany, along with your business ideas and professional plans.

- Curriculum Vitae (CV). Include relevant work experience.

- Proof of professional qualifications. Necessary degrees, diplomas, or licences, particularly for regulated professions.

- Client letters or contracts. Obtain at least two contracts or letters of intent from German clients outlining the scope of work, payment terms, and economic contribution to Germany.

- Freelance business plan. Include financial forecasts and a financing plan, if necessary.

- Proof of accommodation. Provide a rental contract or Anmeldung (residence registration certificate) in Germany.

- Proof of financial means. Use bank statements, a blocked account, or sponsorship letter to show you can cover living and business expenses.

- Health insurance. Proof of German public or private health insurance.

- Pension plan or retirement provisions, if you are over 45.

- Duplicates. Prepare copies of all documents in duplicate.

Additional documentation may be necessary for certain professions requiring regulated activities or permits.

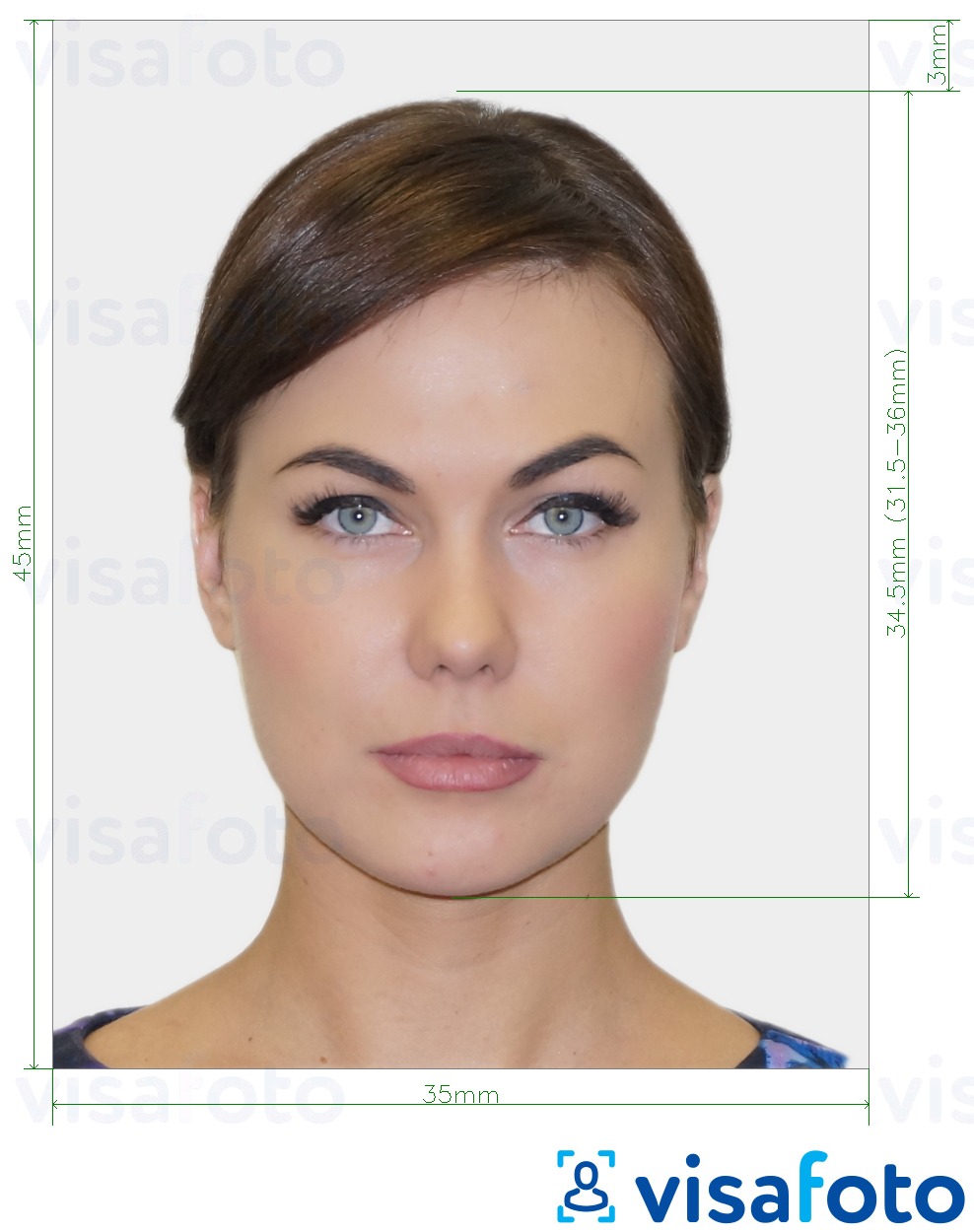

German visa photo requirements

Your application must include a biometric photo that meets strict German standards. The image should follow precise rules for size, background, and facial expression to be accepted. Here’s what you need to know to ensure your photo complies with official requirements:

- The photo must be 35x45 mm (1.37x1.77 inches).

- Your face should occupy about 70% to 80% of the photo.

- For online applications, use a JPG/JPEG format, high resolution, with a maximum file size of 120 KB.

- The background should be a plain, light gray or white with no shadows or patterns.

- Ensure there are no red eyes, reflections, or shadows on your face.

- Head coverings are allowed only for religious reasons and must not obscure the face.

- It is best to avoid wearing glasses. If you do wear them, make sure that there are no tinted lenses or reflections.

- The photo must have been taken within the last 6 months.

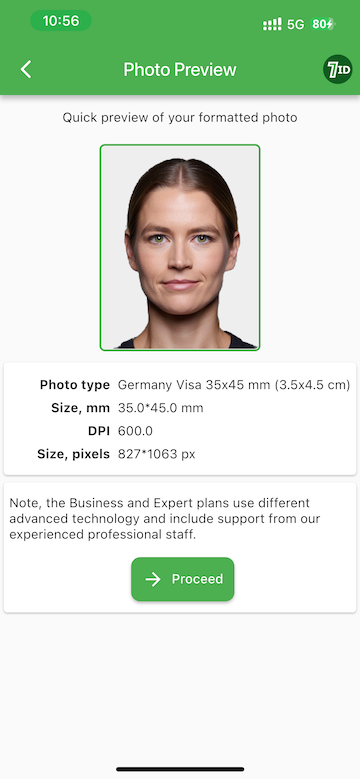

Here is an example:

Get your German visa photo online instantly

The approval rate of your visa application is higher if you have a professional photo. Use the Visafoto service to get a top-quality picture online. Visafoto boasts a 99.7% success rate with visa photographs.

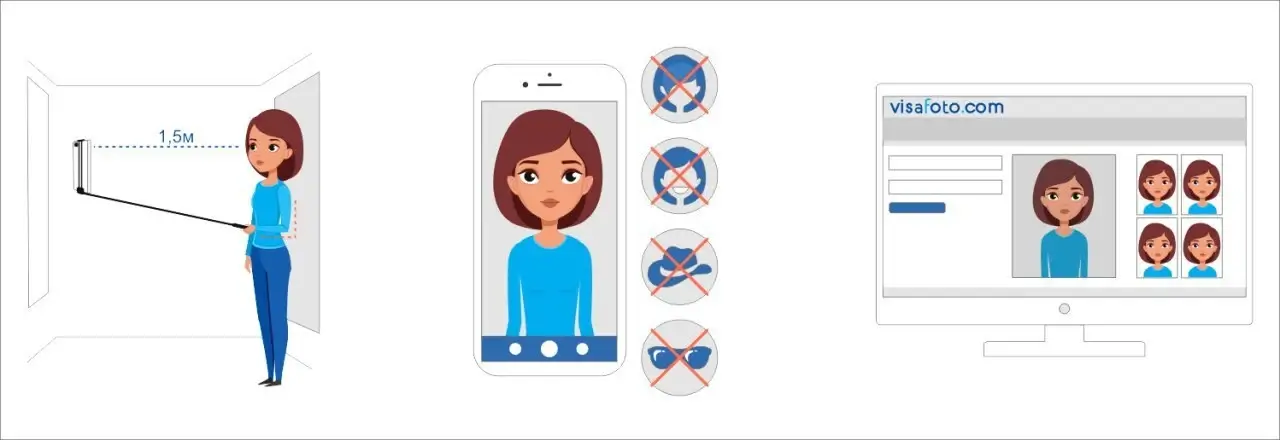

Simply take your photo in daylight using your phone or digital camera, then upload it to Visafoto.com. The service will adjust the background, resolution, apply colour correction, and crop the image to the necessary size.

Below is an example of the type of photo you can upload:

You’ll receive a digital copy suitable for online submissions and a print-ready version. If you’re not satisfied, we offer free replacements. If officials reject the photo, you will receive a full refund.

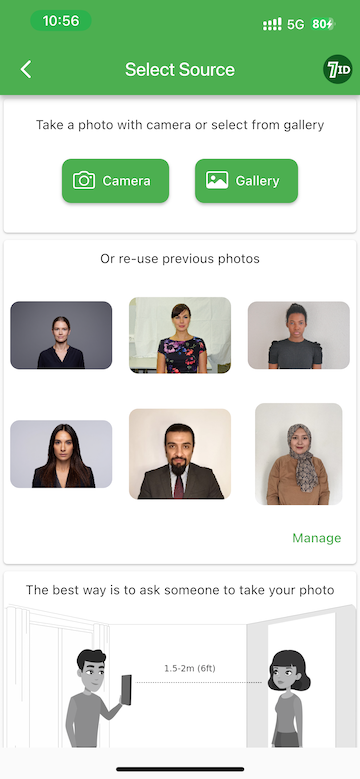

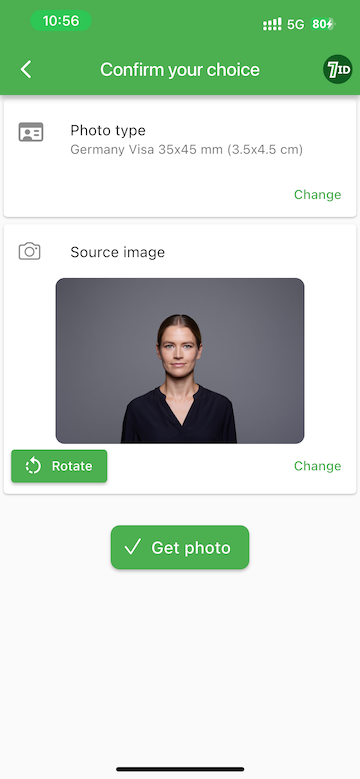

German visa photo app

For added convenience, try the 7ID app from Visafoto.com. This user-friendly app helps you to create ID, passport and visa photos directly on your smartphone. It works on both iPhones and Android devices.

Upload your photo to the 7ID App, select Germany as the country and “visa” as the document type. The app automatically aligns your photo with official standards, adjusting size, format, and background colour, while centring your face and eye line perfectly. You’ll receive a digital file and a print template fit for standard paper sizes like 4x6, A4, A5, or B5.

Our technical support team is available 24/7 to assist with any queries.

German freelance visa costs

Applying for a freelance visa in Germany involves several fees, including application charges and possible translation or certification expenses. Knowing the full cost in advance helps you budget effectively. Here's a breakdown of typical expenses:

- Visa application fee: Expect to pay between €75 and €100 when you submit your application at a German embassy or consulate. This fee depends on your nationality and the specific consulate. Remember, it is non-refundable, even if your application is denied.

- Residence permit fee: After arriving in Germany, you'll need to secure a residence permit. The initial permit generally costs around €100, with similar fees for renewals.

- Health insurance: Insurance is mandatory for all applicants. Monthly premiums range from approximately €100 to €300, depending on your provider and whether you opt for public or private insurance.

Additional costs might include fees for obtaining official financial documentation, renewing your visa (€80-€100), and extra service fees if you apply through a visa application centre.

Freelance visa processing time

Processing times for freelance visa applications vary depending on where you apply and how complete your documents are. Most applicants receive a decision within a few weeks to a few months. Understanding the timeline helps you plan your move and start your work in Germany without delay.

In 2025, the typical processing time for a German freelance visa is between 6 and 10 weeks. However, it can take up to 3 months, depending on factors such as application volume, the completeness of your documents, and the specific embassy or immigration office handling your case.

If you're applying from outside Germany through embassies or consulates, expect an average processing time of around 6 to 10 weeks. If you're applying from within Germany, the timeline may vary more noticeably based on local immigration office workloads.

Taxes, social security, and business registration rules

As a freelancer in Germany, you'll need to manage your own taxes, register your business, and potentially contribute to social security. These obligations ensure you operate legally and can access essential services. Here’s what you need to know:

Taxes

- Income tax (Einkommensteuer): Tax rates range from 14% to 45%, depending on income. For 2025, you benefit from a tax-free allowance of €12,096. You calculate taxable income using a simplified income excess calculation (EÜR). Submit your tax returns annually and make quarterly tax prepayments by March 10, June 10, September 10, and December 10.

- Value added tax (Umsatzsteuer or VAT): The standard VAT rate is 19%, with a reduced 7% for certain services. If your yearly turnover is below €25,000, you might qualify for the small business scheme (Kleinunternehmerregelung), which exempts you from collecting and reporting VAT.

- Trade tax (Gewerbesteuer): Freelancers are exempt from trade tax, which applies only to commercial businesses.

- Solidarity surcharge: Primarily affects high earners.

- Tax-deductible expenses: You can deduct business expenses, work-related costs, and depreciation from your taxable income.

Social security

While freelancers aren’t typically required to join mandatory social security systems as employees are, you must secure health insurance either through public or private options. Additional recommendations include disability insurance and private pension plans. Contributions to state pension insurance are voluntary unless you work in a regulated profession.

Business registration

Most freelancers don’t need to register a trade (Gewerbeanmeldung), since freelancing is considered a liberal profession. If your activity is deemed commercial, you must register with the local trade office. Register your freelance work with the tax office (Finanzamt) to obtain a tax number and VAT ID if applicable. This involves completing a questionnaire about your freelance activities. Some professions may require specific licenses or permits.

Freelance visa extension and residence permit

Once you have a freelance visa in Germany, you can extend it by consistently meeting the necessary conditions and demonstrating sustainable income. This visa may eventually lead to permanent residency.

To renew your freelance visa, begin gathering your renewal documents 3 to 6 months before your current visa expires. Essential documents include updated financial proof like bank statements and tax returns, current client contracts or letters of intent, valid health insurance proof, and, if you’re over 45, evidence of a suitable pension plan. During the renewal process, the immigration office (Ausländerbehörde) might conduct an interview to discuss your freelance activities, clients, and future plans. Upon successful extension of your German freelance visa, your residence permit can last up to 3 years and be renewed continuously.

Can freelancers get permanent residence in Germany? Yes, after 3 to 5 years of legal residence and ongoing freelance work, you can apply for permanent residency (Niederlassungserlaubnis) or possibly naturalization, given you meet other specified conditions.

FAQ

Who qualifies as a freelancer under German law?

In Germany, a freelancer ("Freiberufler") operates independently, offering services based on intellectual, scientific, artistic, teaching, or healthcare expertise. They work under their own name and responsibility, without needing a commercial trade licence.

What is an average German freelance visa success rate?

Success rate for a freelance visa is generally high when applicants meet all eligibility criteria. Authorities now scrutinize applications more closely to ensure legitimate freelance work, not hidden employment. Applicants who thoroughly prepare and meet all requirements for a German freelance visa stand a strong chance of obtaining visa approval.

Can I apply for a freelance visa inside Germany?

Yes, under certain conditions. Citizens from countries like Australia, Canada, Israel, Japan, New Zealand, South Korea, the UK, and the US can enter Germany without a visa and apply directly at a local immigration office (Ausländerbehörde) for a Germany freelance residence permit. Others typically need to apply from their home country through a German embassy or consulate. If you hold a valid residence permit or another visa allowing self-employment, you can switch to or apply for a freelance visa within Germany.

Can I switch from a freelance visa to a work visa later?

Yes, transitioning from a freelance to a work visa in Germany is possible, but it requires a separate application. You must meet work visa requirements, including having a job offer, employer sponsorship, and potentially meeting salary thresholds. This switch involves submitting an employment contract, proof of qualifications, health insurance, and other standard job visa documentation at the local immigration office.

Last updated: 2025-11-06