PAN Card Application In India: Ultimate Guideline

If you're an Indian citizen or a foreign national residing in India, you've likely heard about the PAN card. The Permanent Account Number (PAN) card is a crucial identification document issued by the Indian Income Tax Department. Whether you're a taxpayer, a salaried employee, or a business owner, a PAN card is essential for various financial transactions and compliance purposes. However, navigating the PAN card application process can be daunting, especially for first-time applicants or those unfamiliar with the requirements and procedures.

This comprehensive guide will walk you through India's PAN card application process. Whether you need it for taxation purposes, opening a bank account, or conducting high-value transactions, we've got you covered.

Table of contents

- PAN card benefits

- Who is eligible to get a PAN card in India?

- PAN card application process

- Documents required to apply for a PAN card

- PAN card for foreigners: rules and required documentation

- e-PAN card explained

- PAN card application costs

- PAN card photo requirements

- Get a PAN card application photo online in seconds!

- How to fill a PAN card application form: helpful tips

- How long does it take to get a PAN card?

- How to track your PAN card application?

- PAN card validity and renewal

PAN card benefits

The PAN card, or Permanent Account Number card, offers numerous benefits to individuals in India. Firstly, it serves as a unique identification number essential for various financial transactions and official purposes. With a PAN card, you can easily open bank accounts, apply for loans, file income tax returns, and engage in investments such as buying shares or mutual funds.

Furthermore, the PAN card is required for anyone who wishes to work or earn an income in India. It is mandatory for salaried employees, self-employed individuals, and business owners. Additionally, having a PAN card helps prevent tax evasion and ensures transparency in financial transactions, contributing to a more robust and accountable economic system.

The PAN card is widely accepted as an identification document across various government and private sectors. You can use it for identity verification when applying for a passport, getting a driving license, or participating in government tenders.

If you do not provide your PAN card details to financial institutions, such as banks, they must deduct taxes at a higher rate from your transactions. By quoting your PAN, you can ensure that taxes are set at the applicable rates.

Overall, obtaining a PAN card provides individuals with greater financial opportunities, legal compliance, and a hassle-free experience when dealing with financial institutions and government agencies.

Who is eligible to get a PAN card in India?

Basically, the PAN card is available to each Indian citizen, resident or even non-resident. The eligibility criteria for obtaining a PAN card in India vary depending on the applicant’s category. Here's a breakdown of all the eligible types:

Individuals (residents and non-residents):

- Any citizen of India.

- Non-residents, including foreign nationals conducting business or financial transactions.

- Minors below 18 can also apply for a PAN card. In such cases, their parent or guardian must provide their details and act as the representative assessee.

- A Hindu Undivided Family, comprising individuals of the Hindu, Sikh, Jain, or Buddhist religion, can apply for a PAN card in the name of the HUF. The Karta, or head of the family, represents the HUF for PAN card purposes.

Companies, firms, Institutions

- Any registered company, including public, private, limited liability partnerships (LLPs), or one-person companies (OPCs).

- Partnership firms, including general and limited liability partnerships.

- Trusts, whether registered or unregistered.

- Charitable institutions, educational institutions, research institutions, hospitals, and other similar entities.

- Central or state government departments, as well as their agencies and bodies.

PAN card application process

You can apply for a PAN card online or offline. To apply online, you can use the UTIITSL or the NSDL website.

Online through UTIITSL

- Fill out the PAN card application on the UTIITSL website;

- Pay the application fee;

- Send the documents to the UTIITSL office by courier within 15 days of online submission of Form 49A.

Online through NSDL

- Start the PAN card application on the NSDL website;

- Fill in all the details in the form;

- Pay the required fees;

- Send the required documents through courier/post to the NSDL office

Offline application

- Download Form 49A from the NSDL website;

- Fill in the details in the form;

- Attach your signature and photograph to the form;

- Submit the form and the required documents to the nearest PAN centre;

- Pay the fees for PAN card application;

- Receive the acknowledgment number to track your PAN card application status.

Documents required to apply for a PAN card

Here are the documents you must submit along with your application:

- Proof of identity;

- Recent photograph;

- Proof of address;

- Proof of date of birth;

- Registration certificate in case of companies, firms, HUF, and association of persons.

PAN card for foreigners: rules and required documentation

To apply for a PAN, foreign citizens, whether through online or offline channels, need to meet specific eligibility criteria. These include:

- Non-Resident Indians (NRIs) who possess a taxable income in India;

- NRIs engaged in share trading through a broker or a depository;

- Individuals who are interested in investing in mutual funds;

- NRIs seeking to invest in land or property within India.

The required documents are the same, with the addition of the following:

- Copy of OCI (Overseas Citizen of India) card or PIO (Person of Indian Origin) card;

- An official copy of your address certificate issued by an Indian employer;

- Copy of the appointment letter;

- Details of the PAN card.

e-PAN card explained

An electronic PAN card, or e-PAN card, is a digitally signed virtual version of the PAN card that you can download and save on your smartphone, tablet, or computer.

The e-PAN card contains the same information and details as the physical PAN card, including its holder's name, PAN number, photograph, signature, and other relevant data. It serves as a valid proof of identity and can be used for various purposes, just like a physical PAN card.

The e-PAN card is generated for all new PAN card applications, and existing PAN cardholders can also obtain their e-PAN card by linking their PAN number with their Aadhaar card. The e-PAN card can be downloaded from the Income Tax Department's official website or through the UTIITSL or NSDL portals.

While the electronic card holds the same validity as the physical one, you may still need to present the physical card in certain situations where physical verification is necessary, such as at airports or government offices.

PAN card application costs

Applicants residing in India must pay a PAN card fee of Rs 110, which comprises a processing fee of Rs 93+GST of 18%.

If you need a PAN card to make financial transactions outside of India, the price will be Rs 1011.00.

If you need to renew or re-issue an existing Pan Card, you must pay a fee of Rs. 110. Foreign entities must pay a charge of Rs 1020.

The e-PAN Card processing fee is Rs 66 both for Indian citizens and foreigners.

PAN card photo requirements

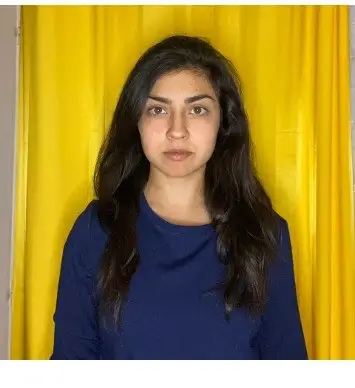

- The picture must be in colour and of good quality. The lighting and contrast must be even. No blurred, pixelated, or otherwise distorted photos may be accepted;

- The required PAN card photo size is 25 x 35 mm;

- The photo background must be white;

- The height of your head in the picture (from crown to chin) should be about 73% of the photo height;

- Your face must be fully visible, and your eyes must look straight into the camera. Keep a neutral facial expression;

- Your face must be centred in the picture;

- Your clothes should contrast with the background (not white) and must not be patterned;

- Headdresses are only allowed for medical or religious reasons but may not obscure facial features.

Here is an example of a PAN card photo:

Get a PAN card application photo online in seconds!

Do you want to get your PAN card done as quickly as possible? Then don’t waste your time when you can save it. Get your PAN card photo done professionally to ensure it will be accepted upon submission.

Visafoto has been editing photos for documents worldwide since 2013. It can adjust your photo to suit the requirements, such as background and size, including subtler ones like the head size in the picture and even head tilt.

To use Visafoto’s services, just upload your portrait to the tool below. Don’t worry about sizing and background; simply ensure your photo has good lighting and follow the required dress code and posing rules.

Take an image with a smartphone or camera against any background, upload it here, and instantly get a professional photo for your visa, passport, or ID.

Source

Result

First, take a photo of yours under daylight like this one:

Whether you’re applying online or offline, Visafoto has your back! You will get a file containing your digital photo and a ready-to-print template to print your photo without fussing about paper formatting.

How to fill a PAN card application form: helpful tips

Filling out a PAN card application form can be a straightforward process if you follow these recommendations:

- Obtain the correct form: Visit the official website of the Income Tax Department of India or authorized PAN service providers to download the PAN card application form (Form 49A for Indian citizens and Form 49AA for foreign citizens);

- Read the instructions carefully: Before you begin filling out the form, thoroughly read the accompanying instructions. This will help you understand the requirements and provide accurate information. For example:

- The form is to be filled only in English;

- Use only black ink to fill out the form if filling it by hand.

- Provide accurate personal details: Fill in your personal details such as full name, date of birth, gender, and address. Double-check the information for accuracy, as any mistakes may lead to delays or rejection;

- Provide valid documents as proof: Attach the necessary documents to establish your identity, address, and date of birth. This usually includes a passport, Aadhaar card, driving license, or any other acceptable documents as per the instructions;

- Affix a recent passport-sized photograph in the provided area, ensuring it is clear and not stapled or clipped.

- Provide contact information: Include your email address and mobile number accurately. These details are essential for future communication and updates.

- Before submitting the form, review all the details entered to ensure accuracy and completeness. Any errors or missing information should be corrected before final submission.

Remember to keep copies of the filled form, supporting documents, and payment receipts for your records.

How long does it take to get a PAN card?

Usually, the PAN card processing time takes about two weeks, given that the application is correct and complete.

How to track your PAN card application?

You can track your status through the NSDL website using your acknowledgment number. You can also check it on the UTIITSL website using your PAN or Application Coupon Number.

PAN card validity and renewal

Pan card does not expire; it is valid for as long as its holder lives. However, the holder can apply for a new one in case of loss, damage, and other cases.