India PAN Card for NRIs: Who Needs It, Aadhaar Rules & Easy Application Guide

If you earn, invest, or hold assets in India as a non-resident, a PAN card directly affects your tax position and financial access. This guide explains who needs a PAN, how to apply for and convert an Indian PAN card to NRI status correctly.

Table of contents

- What is a PAN Card, and Why Does it Matter to NRIs?

- Who Actually Needs a PAN Card?

- When an NRI May Not Need a PAN

- Aadhaar–PAN Linking Rules for NRIs in 2026

- Step-by-Step: How NRIs Can Apply for PAN Online

- Form 49A vs. Form 49AA: Which One Should You Use in 2026?

- Documents Required for PAN Card Application

- PAN Card Photo Requirements

- Get Your PAN Card Photo Online!

- PAN Card Fees for NRIs

- How to Update the Resident Status of a PAN for an NRI

- FAQ

What is a PAN Card, and Why Does it Matter to NRIs?

A PAN card is India’s primary tax identification number and a legal requirement for most financial activities linked to Indian income. Here you'll find out why you may need a PAN card and when it is mandatory.

A PAN, known as the Permanent Account Number, is a distinctive 10-digit alphanumeric identifier issued by India's Income Tax Department. It is vital for tracking financial transactions and ensuring tax compliance. Serving as a crucial identification for taxes, investments, and high-value transactions, it plays an integral role.

Can an NRI have an Indian PAN card? Absolutely. NRIs, as well as OCIs (Overseas Citizens of India) and foreign nationals earning from Indian sources such as rental income, capital gains, dividends, or business profits, often require a PAN card. If an individual's Indian income exceeds the basic exemption limit (₹2.5 lakh for FY 2025-26), having a PAN card becomes mandatory for engaging in taxable transactions. Without it, they face increased Tax Deducted at Source (TDS) rates, transaction restrictions, and difficulties in claiming refunds.

In 2026, possessing a PAN card is practically necessary for engaging in high-value transactions, including property sales or purchases over ₹10 lakh, transactions in goods/services over ₹2 lakh, and dealings in mutual funds, securities, or bank accounts. Without a PAN, NRIs and OCIs face a 20% TDS on payments, hindering investments and refund claims.

According to Section 139A of the Income Tax Act, anyone (including NRIs) with taxable Indian income exceeding the exemption limits or engaging in specified transactions like property deals must have a PAN. NRIs required to file Income Tax Returns (ITR) for Indian-source income must obtain a PAN to meet compliance requirements. Failure to do so results in higher TDS under Sections 206AA/206CC, ensuring proper tracking of non-resident tax obligations without exemptions based on residency.

Is there any difference between an NRI PAN card and a normal PAN card? There is no difference between them in terms of format, structure, validity, or functionality. The only variation lies in the residential status indicated in tax databases: "Resident" for locals and "Non-Resident" for NRIs/OCIs, updated by the Assessing Officer. This distinction influences TDS rates and Aadhaar exemptions but not the PAN card itself.

Who Actually Needs a PAN Card?

Any NRI with income taxable in India must obtain a PAN to report earnings and pay taxes correctly. The same applies to NRIs who invest in Indian assets - such as property, shares, mutual funds, or fixed deposits - where PAN is required to comply with tax and reporting rules. Below are the details.

NRIs with taxable income: If an NRI's income from India - such as rent, dividends, interest, or capital gains - exceeds the basic exemption limit (₹3 lakh under the new regime for FY 2025-26), a PAN is required. It's necessary for filing Income Tax Returns (ITR), claiming TDS credits, and processing refunds. Without a PAN, TDS rates increase to 20-30%, causing higher tax payments.

NRIs investing or holding assets: NRIs investing in mutual funds, stocks, bonds (over ₹50,000), or holding assets like property need a PAN, even if they have no current income. Transactions like property sales exceeding ₹10 lakh, opening NRO/NRE accounts, or significant deposits/withdrawals (₹50,000+ cash) require it. A PAN ensures smooth transactions and reduced TDS on sales or rentals.

When an NRI May Not Need a PAN

Not every NRI automatically needs a PAN card. Below are the cases.

NRIs without taxable income from India (such as rent, dividends, capital gains) are not obligated to obtain a PAN or file an ITR if their income is below the exemption limits. Agricultural income from rural lands is tax-exempt. This remains unless other conditions apply.

Rule 114B states that NRIs can bypass the PAN requirement for certain transactions, such as buying goods/services over ₹2 lakh, hotel payments over ₹50,000 in cash, foreign travel, or minor deposits under ₹50,000. Basic NRI bank accounts or small fixed deposits may use Form 60 instead. Furthermore, NRIs aren't required to link PAN with Aadhaar.

Even if legally exempt, not having a PAN can block access to demat accounts, investments in mutual funds over ₹50,000, property transactions over ₹10 lakh, and TDS refunds. NRIs often opt to get a PAN proactively to avoid future difficulties.

Aadhaar–PAN Linking Rules for NRIs in 2026

Aadhaar–PAN linking rules differ for NRIs compared to resident Indians. Below, we explain this distinction to help you avoid unnecessary penalties or an invalid PAN status.

By 2026, linking Aadhaar and PAN is mandatory for those who possess both, but this mainly applies to resident Indians and those eligible for an Aadhaar. According to Section 139AA of the Income Tax Act, taxpayers with both an Aadhaar and a PAN must link them. However, NRIs without Aadhaar are exempt from this requirement because Aadhaar eligibility is based on residing in India for over 182 days annually.

NRIs who don’t have an Aadhaar are not required to link their PAN under Section 139AA. Those holding an Aadhaar must link it to their PAN by January 1, 2026, to prevent their PAN from becoming inactive, which can disrupt tax filings, refunds, and financial transactions. Updating your status to "non-resident" on the Income Tax e-filing portal clarifies exemption from linking.

Does an NRI need an Aadhar card in India? Legally, NRIs don’t need an Aadhaar card in most cases, but they can obtain one. Having an Aadhaar can simplify e-KYC processes, opening bank accounts and telecom services, and streamline certain property and fintech activities.

Step-by-Step: How NRIs Can Apply for PAN Online

NRIs can apply for a PAN card entirely online via authorized portals without needing to travel to India. This process requires selecting the correct form, uploading documents, paying a fee, and completing verification. Here is how an NRI can get a PAN card:

- Visit the NSDL website or UTIITSL Portal.

- Choose "New PAN – Indian Citizen (Form 49A)" or "Foreign Citizen (Form 49AA)" and enter details to receive a token number via email.

- Fill out the form with your personal, contact, and address (including overseas), and parental information. Indicate NRI status.

- Upload or scan documents such as your passport (as primary ID and address proof) and affix a photo and signature if needed.

- Pay the fee online using a card or net banking. You will receive a 15-digit acknowledgment PAN number for NRI.

- Print the completed form, sign it, attach your photo, and send document copies via courier to the NSDL or UTIITSL address in India if necessary. If a fully online submission is allowed, mailing may be skipped.

- Track your PAN application status using the acknowledgment number. You will receive your e-PAN by email in 4-5 days, and the physical card will arrive in 2-3 weeks abroad.

PAN card replacement for NRIs: NRIs can replace a lost, damaged, or outdated PAN card by applying for a “Reprint of PAN Card” or “Change/Correction in PAN Data” through the official NSDL (Protean) or UTIITSL portals. The PAN number stays the same - only the card or recorded details are reissued.

The process is fully online: select the replacement option, confirm your PAN, upload identity and address proof (foreign address allowed), submit a photo and signature if required, and pay the applicable fee. You can choose e-PAN (PDF) for quick access or request a physical card delivered to an Indian or overseas address, with higher charges for international dispatch.

Form 49A vs. Form 49AA: Which One Should You Use in 2026?

Choosing the correct PAN application form depends on your citizenship, not your residence. Using the wrong form is a common reason for delays or rejection. Here you'll find out which form applies to you.

Form 49A: Indian citizens, whether residing in India or as NRIs, need to use Form 49A. This form applies to individuals, Hindu Undivided Families (HUFs), Indian companies, partnerships, and trusts formed in India. Even NRIs with Indian citizenship should use this form for overseas addresses to avoid the additional KYC requirements of Form 49AA.

Form 49AA: Foreign nationals, Overseas Citizens of India (OCIs), Persons of Indian Origin (PIOs prior to 2015), foreign companies, or entities investing in India submit Form 49AA. This form includes additional KYC details such as country of citizenship, beneficial ownership, and SEBI-compliant proofs for Qualified Foreign Investors. The rules for 2026 remain unchanged under the Income Tax Act.

Documents Required for PAN Card Application

PAN applications require proof of identity, date of birth, and address, with slightly different document lists for NRIs and foreign citizens. All documents must be valid, readable, and match the details entered in the application. Inconsistent or expired documents are a frequent cause of processing issues. Here are the PAN card documents required in India for NRI applicants:

Proof of Identity (Choose One):

Indian or foreign passport (with name and photo page)

OCI or PIO card (with name and photo page)

Valid Indian visa (if applicable)

Proof of Address (Choose One, Overseas Accepted):

Passport (last page with address).

Bank statement (last 3 months, NRE/NRO with 2 transactions, attested).

Utility bill (electricity, gas, water, landline; recent 3 months).

Driving license or residence permit.

Proof of Date of Birth (Choose One):

Passport or birth certificate

Driving license or matriculation certificate

Additional Items Required:

Two recent passport-size photos (for physical form submission).

Provide photocopies or scans only, no originals needed.

For companies: include an attested incorporation certificate if foreign.

PAN Card Photo Requirements

The photo submitted with a PAN application must meet strict size, clarity, and background standards. Even minor deviations - such as incorrect dimensions or poor lighting - can lead to rejection. Below are the official photo guidelines.

- Your PAN card photo size must be 3.5 × 2.5 cm, with a resolution of 200 DPI, in JPEG format under 50 KB. For digital submissions, ensure dimensions of 590×826 pixels.

- The head should occupy 70-80% of the photo frame, with the entire face clearly visible.

- Use a colour photo of high quality.

- The background must be white.

- Maintain a neutral expression, looking directly at the camera.

- Center your face in the frame.

- Head coverings are permissible for medical or religious reasons, but must leave facial features unobscured.

- Opt for solid-colored clothing, avoiding white or patterns.

- If wearing glasses, eliminate glare and ensure they do not conceal your eyes. Avoid tinted glasses.

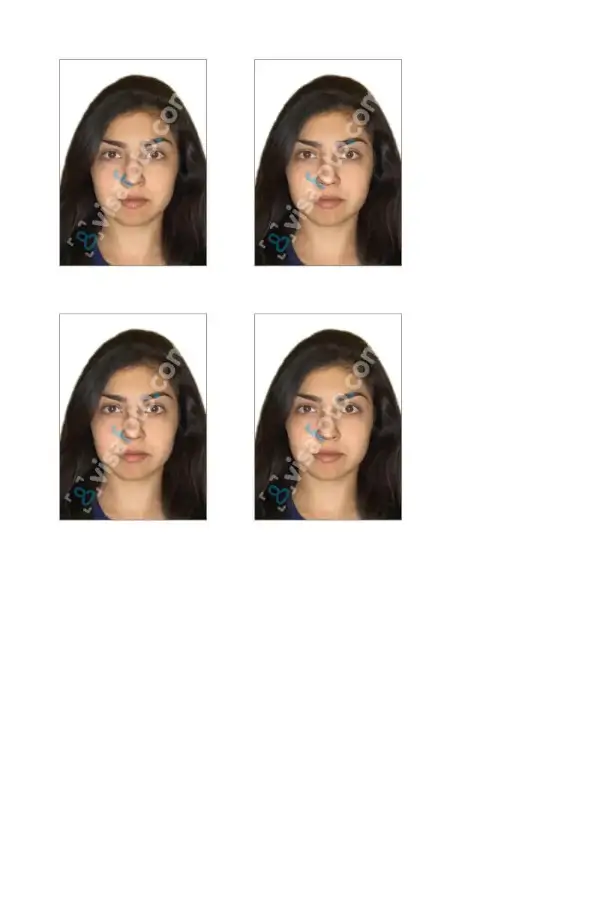

Example of an NRI PAN card photo:

Get Your PAN Card Photo Online!

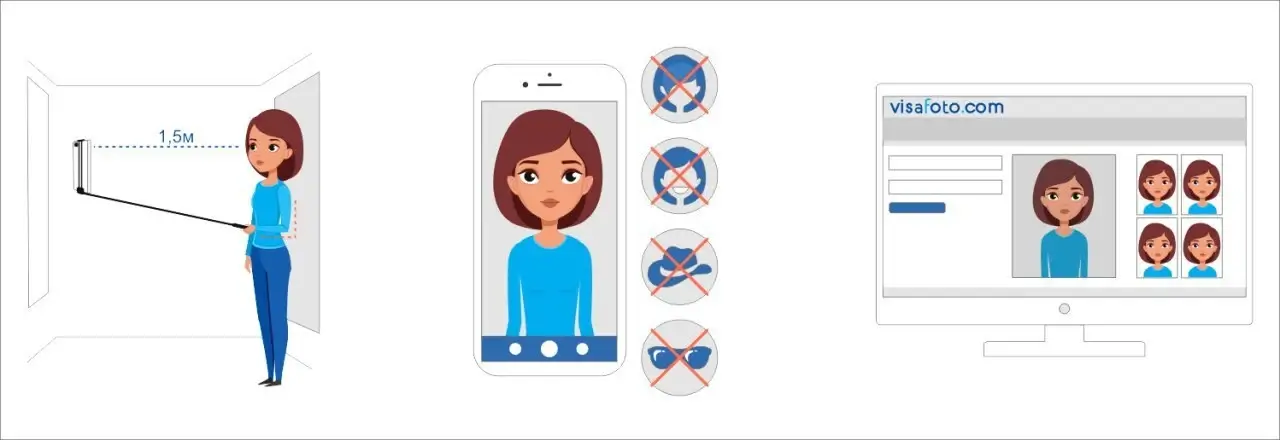

Here you’ll find out how to take a high-quality PAN card photo at home in minutes.

You no longer need a photo studio for a professional document picture. With Visafoto, a leading photo editor, you can generate a compliant PAN card photo in two steps:

- Upload a photo taken in natural daylight to Visafoto’s tool.

- Choose the country and document type (e.g., India, PAN card).

And you're done! Visafoto will automatically adjust the background, size, and head position to fit official requirements. You’ll receive a digital version perfect for online submissions and a format ready for printing.

Example of a suitable upload for Visafoto:

Result from Visafoto:

Visafoto boasts a 99.7% acceptance rate and more than 1,000,000 photos accepted by government authorities. We guarantee compliance with official standards or offer a full refund. Our tech support is available 24/7 for any assistance.

PAN Card Fees for NRIs

What are the PAN card application fees for foreign nationals? In 2026, the price of getting a PAN card as an NRI depends on whether you want a physical card or just an e-PAN, as well as your delivery location. Both UTIITSL and NSDL (Protean) offer standardized PAN card fees for NRIs. If you need the physical card sent overseas, the cost ranges from INR 1,011 to INR 1,017, including 18% GST, due to courier charges. Opting solely for an e-PAN can significantly reduce expenses. Here's a breakdown of these costs:

| Submission Mode | Physical PAN (Overseas) | e-PAN Only |

|---|---|---|

| TIN Centres/Online with documents | INR 1,017 | INR 72 |

| Paperless/Digital (e-KYC, scans) | INR 1,011 | INR 66 |

The fees cover the expenses of processing the application, delivery via DHL or FedEx for international locations, and applicable GST.

How to Update the Resident Status of a PAN for an NRI

How can I update my PAN card to NRI status? If your status changes to non-resident, it’s essential to update your PAN record. This ensures accurate tax processing and reflects correct TDS rates. There's no charge for this update, and it typically takes 7-15 days. Follow these steps to update PAN card details for an NRI:

Online Profile Update:

- Log in to the Income Tax Department Portal with your PAN and password. First-time users need to register.

- Go to "My Profile" and select "Edit." Change your residential status to "Non-Resident" and save the changes. This updates your PAN information immediately, which is essential for tax return filings and transactions.

Submit to the Assessing Officer:

- Locate your Assessing Officer (AO) using the "Know Your AO" feature on the portal by entering your PAN or mobile number.

- Send required documents - passport with visa/address details, OCI card (if applicable), proof of foreign address, PAN copy - via email or post. Include a request to update your status to NRI, mentioning your stay dates. Track any pending status updates through the grievance system if needed.

Grievance Submission: If changing your status online doesn't work, file a grievance. Choose "Assessing Officer" and the category "PAN/Profile - Residential Status Change." Upload necessary documents and explain the status update requirement. The AO will verify and make the update.

FAQ

How to change a resident PAN to an NRI PAN?

NRIs can update their PAN status from resident to NRI through the Income Tax e-filing portal or by sending documents to their Assessing Officer. Here is how to update an NRI status in a PAN card online:

- Log in to the Income Tax Department Portal.

- Navigate to "My Profile" > Edit > Select "Non-Resident" > Save.

How to make a PAN card operative for an NRI?

To make your PAN card active as an NRI, update your residential status to "Non-Resident" by emailing your Jurisdictional Assessing Officer (JAO). Here is how to activate a PAN card for an NRI online:

- Use "Know Your AO" at the Income Tax Department Portal with your PAN or mobile number to find the JAO email.

- Send an email with copies of your PAN, passport (showing overseas stay), and OCI (if applicable), requesting an NRI status update. Your PAN becomes active after verification, typically within 7-15 days.

Do you need a PAN card to buy property in India?

Yes, as per Income Tax Rules (Rule 114B), both buyers and sellers must quote their PAN for real estate transactions over ₹10 lakh, covering residential, commercial properties, or land. This applies to NRIs too, preventing property registration without a PAN.

Do NRIs need to link Aadhaar and a PAN card?

NRIs are not required to link Aadhaar with PAN unless they have an Aadhaar number, as Aadhaar is based on Indian residency. Without Aadhaar, linking is optional. However, if an NRI has Aadhaar, linking it to PAN is mandatory as per current regulations. Missing the link deadline may cause PAN to be inoperative for certain uses.

Can I download an e-PAN card online?

Yes, you can download your e-PAN card for free if issued within the last 30 days, or via NSDL, UTIITSL, or the Income Tax e-filing portal:

- E-Filing Portal: Visit Income Tax Department Portal > Instant e-PAN > Enter Aadhaar > Verify via OTP > Download as PDF (password is your DOB in DDMMYYYY format).

- NSDL/UTIITSL: Go to the NSDL website or UTIITSL Portal > Download e-PAN > Enter PAN/DOB > Verify via OTP > Receive download link (a small fee applies if post-30 days).

The e-PAN has the same legal standing as a physical card; print it on A4 paper for use. NRIs can access it via their registered email or mobile.